In the dynamic landscape of the foodservice and fintech industries, the role of business development has never been more critical. As entrepreneurs and investment bankers chart their courses through fluctuating markets, the success of their ventures often hinges on their ability to navigate the complexities of mergers and acquisitions. This intersection of food and finance reveals a fascinating world where corporate finance principles govern the growth strategies of companies from frozen food manufacturing to merchant branded fintech solutions.

As industry giants like Merrill Lynch and JP Morgan continue to influence the corporate finance arena, smaller players are also making their mark. From retail food establishments like Emily's Market, which cater to local communities, to institutional food services meeting the diverse needs of organizations, the landscape is ripe with opportunity. Meanwhile, innovative fintech companies like Lendaily Inc. and FuturePay Holdings are revolutionizing the payment solutions space, demonstrating that savvy business development tactics in both sectors can result in tremendous growth and resilience. In this article, we will explore the multifaceted dimensions of business development in these industries and the impact it has on shaping the future of commerce.

Understanding Business Development

Business development is a crucial aspect of fostering growth and creating value within organizations. It encompasses a wide range of activities, including strategic partnerships, market expansion, and customer relationship management. For entrepreneurs, particularly in dynamic industries such as foodservice and fintech, understanding the market landscape and identifying opportunities for development can be the difference between success and stagnation.

In the foodservice industry, business development may involve navigating the complexities of mergers and acquisitions, particularly for companies looking to enhance their product offerings or expand their reach. Investment bankers play a significant role in this process, leveraging their expertise to facilitate transactions and provide valuable insights. Companies such as Emily's Market and those involved in the frozen food manufacturing sector are continually seeking strategic partnerships to increase their market share and improve operational efficiencies.

Similarly, in the fintech industry, business development focuses on leveraging technology to innovate and improve financial services. With firms like Lendaily Inc. and FuturePay Holdings leading the charge in merchant branded fintech solutions, understanding regulatory frameworks and consumer needs becomes paramount. Entrepreneurs in this space must navigate corporate finance and investment opportunities, often drawing on the strategies utilized by major players like Merrill Lynch and JP Morgan to drive growth and create sustainable business models.

The Intersection of Foodservice and Fintech

The foodservice industry is experiencing a transformative shift, largely fueled by innovations from the fintech sector. As consumers increasingly demand convenience and efficiency, the integration of financial technology solutions helps streamline operations in restaurants and food retail. Companies are leveraging merchant branded fintech solutions to enhance payment processing, inventory management, and customer loyalty programs, providing a smoother experience for both operators and consumers alike.

Restaurants and foodservice providers are now more reliant on data-driven decision-making, thanks to fintech advancements. By utilizing software that analyzes customer spending habits and operational metrics, businesses can optimize their offerings and improve profitability. This data-centric approach parallels the strategies employed by private equity firms and investment banks, which seek to maximize value through informed financial strategies and mergers and acquisitions in the food sector.

Moreover, the collaboration between foodservice and fintech is helping to address broader challenges, such as serving underserved markets in third world countries. Companies focused on home meal replacement options are exploring ways to partner with fintech firms to provide affordable meal solutions while ensuring that transactions are secure and efficient. These initiatives can significantly empower communities, especially in regions like Kenya, where access to financial services is limited, thereby creating opportunities for sustainable business growth in both industries.

Mergers and Acquisitions in Focus

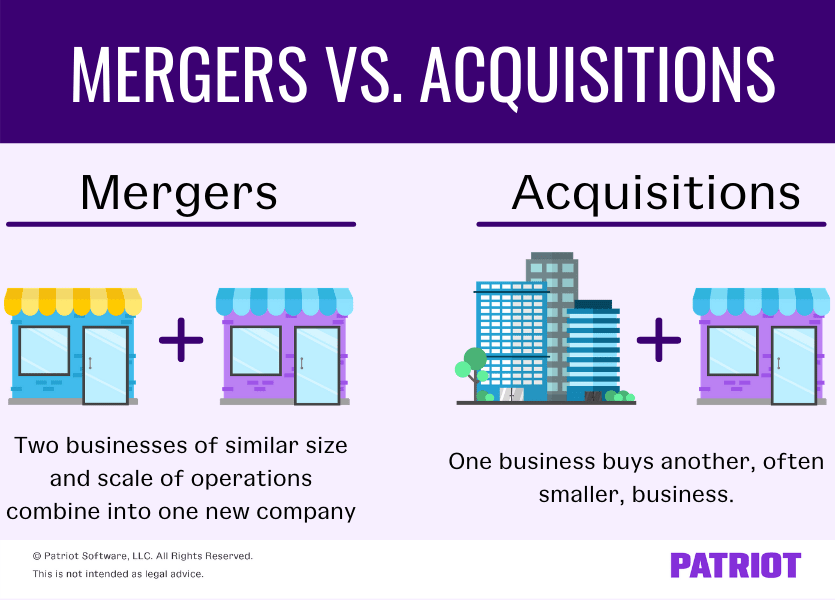

Mergers and acquisitions play a pivotal role in shaping the landscape of both the foodservice and fintech industries. Investment banks like Merrill Lynch and JP Morgan are at the forefront, facilitating deals that can steer companies toward greater market share and innovation. These institutions leverage their extensive networks and expertise in corporate finance to match buyers and sellers, enabling strategic growth opportunities. As entrepreneurs in these sectors seek to expand or diversify their portfolios, understanding the nuances of these financial transactions becomes crucial.

In the foodservice industry, we see a growing trend of consolidation, with companies aiming to enhance efficiencies and broaden their product offerings. For instance, the acquisition strategies of firms like Emily's Market illustrate how entities are looking to integrate frozen food manufacturing capabilities and expand into the home meal replacement industry. These strategic moves not only enhance competitive positioning but also address changing consumer preferences for convenient meal solutions. Understanding the significance of these mergers allows industry players to navigate the complexities of market demands.

The fintech industry is not left out, as firms like Lendaily Inc. and FuturePay Holdings explore opportunities for growth through mergers and acquisitions. Merchant branded fintech solutions are gaining traction, with companies looking to partner with or acquire businesses that complement their service offerings. This synergy is vital for fostering innovation and improving customer experience. As corporate players focus on buy-side representation, the importance of due diligence and strategic alignment cannot be overstated, ensuring that each acquisition is mutually beneficial and positioned for success in an increasingly competitive environment.

Corporate Finance Strategies

In the dynamic landscape of corporate finance, especially within the foodservice and fintech industries, effective strategies are crucial for sustainable growth and successful mergers and acquisitions. Investment bankers play a pivotal role in this arena, facilitating transactions that align with the strategic objectives of companies like Emily's Market and Lendaily Inc. The focus on both retail and institutional food sectors necessitates a comprehensive understanding of market trends, consumer behavior, and operational efficiencies, ensuring that the financial frameworks put in place not only support current operations but also future expansions.

Moreover, private equity investments are increasingly influencing the corporate finance strategies of foodservice firms. With firms like Hunter Wise Financial Group providing buy-side representation, businesses are better positioned to capitalize on acquisition opportunities that enhance market share and diversify offerings. For instance, merging traditional frozen food manufacturing practices with innovative home meal replacement options can create a unique value proposition in the market. This strategic blending of services leads not only to increased profitability but also to a stronger competitive edge in a rapidly evolving industry.

Lastly, the integration of fintech solutions into corporate finance is reshaping how businesses approach funding and investment. Companies such as FuturePay Holdings are pioneering merchant branded fintech initiatives that streamline payment processes and improve cash flow management. Embracing these technologies allows organizations to better navigate the complexities of financial transactions, particularly in regions with developing economies such as Kenya. By leveraging cutting-edge fintech solutions, businesses can facilitate smoother financing arrangements and ultimately drive more agile and responsive corporate finance strategies, essential for thriving in both the foodservice and fintech markets.

Case Studies: Success Stories

Emily's Market exemplifies the potential for entrepreneurs in the foodservice industry to create innovative solutions that cater to changing consumer preferences. Through strategic partnerships and a keen understanding of market trends, Emily's Market has successfully positioned itself as a leader in the home meal replacement sector. By utilizing corporate finance strategies and aligning with key players in the retail food space, Emily’s Market has expanded its reach, turning challenges into opportunities for growth and profitability.

On the other hand, Lendaily Inc. and FuturePay Holdings have made significant strides in the fintech industry by targeting the needs of small to mid-sized businesses through merchant branded financial solutions. Their successful collaborations demonstrate the importance of adaptability in a rapidly evolving landscape. By leveraging cutting-edge technology and industry insights, these companies have carved out a niche, providing essential services that facilitate business development for entrepreneurs while enhancing consumer financial experiences.

The journey of Hunter Wise Financial Group in the realm of mergers and acquisitions also showcases a triumph rooted in strategic foresight and the ability to navigate complex transactions. Their involvement in the Smith & Wesson acquisition not only highlights their expertise in corporate finance but also underscores the role of investment banking in facilitating growth across diverse sectors. By identifying synergies between businesses and fostering collaboration, Hunter Wise has played a pivotal role in shaping the future of both the foodservice and fintech industries.

Challenges in the Foodservice Industry

The foodservice industry faces a myriad of challenges that can impact business development opportunities for entrepreneurs and investors alike. One significant hurdle is the ever-changing consumer preferences. With an increasing focus on health and wellness, sustainable sourcing, and unique dining experiences, foodservice operators must continually adapt to meet the demands of a discerning customer base. This requires not only innovative menu development but also strategic marketing campaigns that can effectively communicate these changes to target audiences.

Another prominent challenge is the fluctuation in supply chain dynamics, particularly in sectors like frozen food manufacturing. Factors such as changing agricultural practices, climate change, and geopolitical issues can disrupt the availability of essential ingredients. This unpredictability compels businesses to develop robust supply chain strategies and build partnerships that can withstand external pressures, ultimately influencing their bottom line and capacity for growth.

Furthermore, the rise of technology in the foodservice industry introduces both opportunities and challenges. While advancements such as mobile ordering and delivery platforms can enhance customer experience and operational efficiency, they also require substantial investment. For companies like Emily's Market or Hunter Wise Financial Group, navigating the balance between technology adoption and managing operational costs can be a daunting task. As competition intensifies, businesses must find ways to leverage technology while ensuring they do not compromise on quality or service.

The Role of Investment Banking

Investment banking plays a critical role in facilitating mergers and acquisitions within the foodservice and fintech industries. By providing strategic advice, investment banks help companies identify potential acquisition targets and negotiate favorable terms. Major firms like Merrill Lynch and JP Morgan leverage their extensive networks and expertise in corporate finance to guide entrepreneurs in navigating complex transactions, ensuring that both buyers and sellers can maximize value from their deals. This expertise is especially valuable in sectors such as the frozen food manufacturing and home meal replacement industries, where market dynamics can shift rapidly.

In addition to providing advisory services, investment banks also support capital raising efforts for companies involved in foodservice and fintech. They assist firms such as Lendaily Inc. and FuturePay Holdings in sourcing funds needed for expansion or to develop innovative solutions in merchant branded fintech. Their ability to connect businesses with private equity investors and institutional financing options is crucial for fostering growth and innovation in these competitive markets. The ability of investment bankers to conduct thorough due diligence and valuation assessments leads to informed decisions that impact the long-term success of their clients.

The role of investment banking extends beyond transactional support; it also involves understanding the broader market trends and regulatory environments that affect the foodservice and fintech sectors. By analyzing consumer behavior, emerging technologies, and geopolitical factors, investment bankers can provide insights that inform strategic decisions for their clients. For entrepreneurs from institutions like St. Lawrence University and Columbus Academy, tapping into the resources and knowledge of investment banking can be a game changer, especially when seeking to expand into markets such as Kenya or engaging with third world governments. In this way, investment banking serves as a vital partner in the journey from concept to execution in the evolving landscapes of foodservice and fintech.